Simple, Flexible, Intuitive

Uncover 401(k) compliance violations in real time and improve Audit accuracy.

Audit Hero for Plan Sponsors, TPA's & 3(16)'s

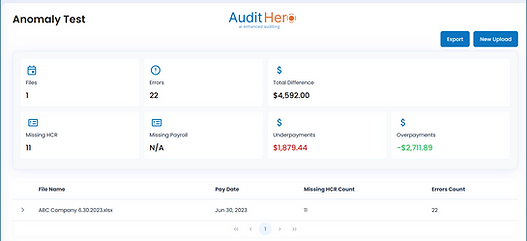

Uncover payroll deferral errors in minutes, not days or weeks! Our solution ensures accuracy and saves you time. Say goodbye to manual checks

Save Time, Improve Accuracy

Our streamlined process ensures you can quickly identify and resolve issues, saving you valuable time and resources. Don't let errors linger—take control of your retirement plan management today!

Avoid Fines; Improve Compliance Posture

401(k) plans are subject to strict regulatory oversight by the Department of Labor (DOL) and the Internal Revenue Service (IRS). Audit Hero for TPA's help TPA's and 3(16)'s uncover errors after every payroll run.

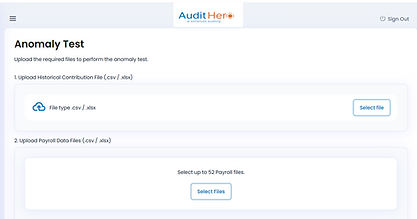

Verify a single payroll or entire year in minutes...

Transform your payroll process with Audit Hero! Simply input one or multiple payrolls, and let our system automatically calculate any over or under payments, streamlining your workflow and saving you precious time and resources. Experience efficiency like never!

Improve Employee Productivity & Morale

Automating 401(k) compliance testing enhances employee productivity and morale by reducing administrative burdens. This allows your team to focus on their core responsibilities while ensuring their you meet your fiduciary duties.

Our Products

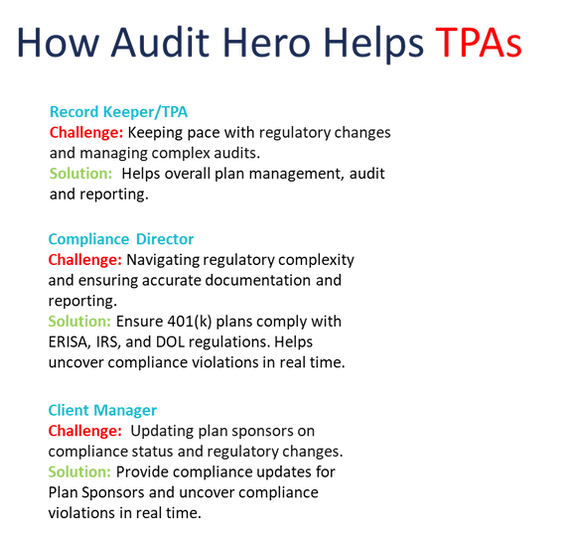

TPAs & 3(16)'s

Audit Hero for TPA's uncovers payroll deferral errors in minutes, not days or weeks! Our solution ensures accuracy and saves you time. Say goodbye to manual checks!

- Uncovers compliance violations in real time

- Ensures compliance with ERISA

- Eliminates time consuming, manual processes

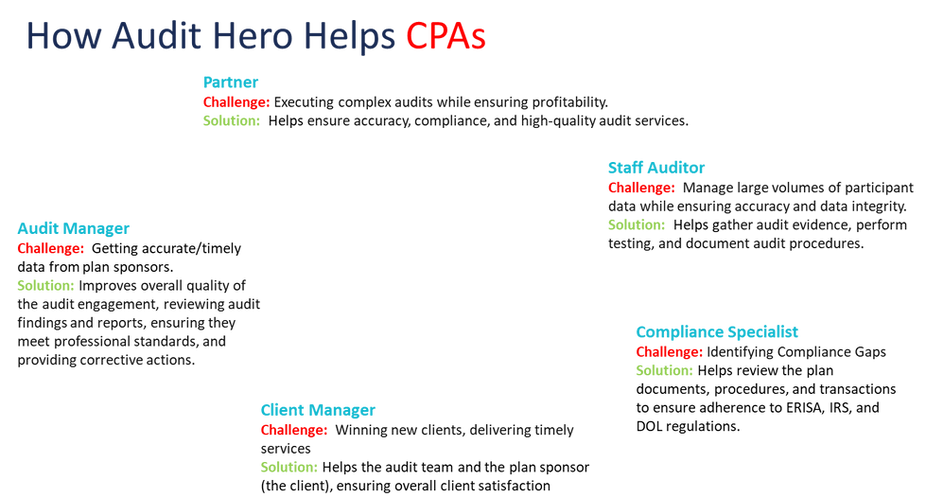

Audit Hero for CPAs automates 401(k) audits, simplifying manual tasks like payroll ingestion and employee deferral error detection. Save time and reduce errors, allowing you to focus on serving clients efficiently. Transform your auditing process with Audit Hero!

- Eliminates manual data extraction

- Reduce audit time, improve accuracy

- Improved profitability

- Repurpose staff to higher value projects

CPAs

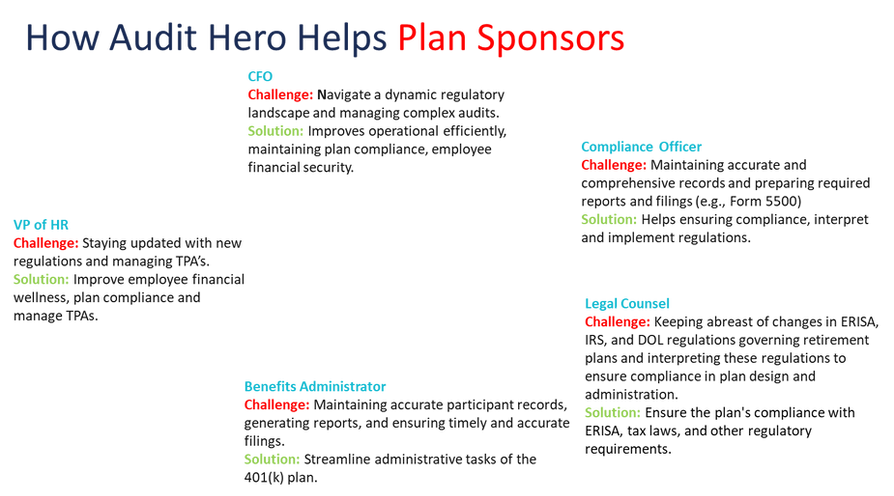

Plan Sponsors

Audit Shield enables Plan Sponsors to maintain 401(k) compliance and ensures employee's retirement are protected.

- Uncover errors in real time

- Validates employee contributions, loans, deferrals are compliant

-Improve compliance posture and avoid costly lawsuits

About Us

The Employment Retirement Income Security Act (ERISA) mandates compliance regulations for company sponsors, record keeper's and CPA's to protect $7+ trillion in U.S. 401(k) retirement savings. Today, there are limited tools to uncover compliance violations as TPA's, 3(16)'s & CPA's rely on archaic manual processes.

The problem is growing: In 2024, Plan Sponsors were fine a record $1.4B for non-compliance and the a recent study found that 84% of 401(k) Plans have ERISA violations.

Audit Hero's mission is to transform 401(k) compliance testing using AI.

Founded by a team of seasoned financial experts and tech visionaries, AuditHero.ai was born out of a shared frustration with the cumbersome and error-prone nature of traditional audit processes. We saw a profound need for a platform that could simplify these complexities without compromising on the thoroughness and precision required by regulatory standards. AuditHero was created — a platform where cutting-edge artificial intelligence meets deep industry expertise.

AuditHero.ai

-

Uncover errors in minutes

-

Save employee resources

-

Avoid fines, ensure compliance

Schedule a Free DEMO Today

Contact Us Today